This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Posted on August 26, 2021 in Marketing Thoughts

The Difference Between Price and Value in Online Products and Services

Price can be understood as the money or amount to be paid, to get something. And value implies the utility of worth of the commodity of service for an individual. Price is the amount of money paid by the buyer to the seller in exchange for any product and service. The amount charged by the seller for a product is known as its price, which includes cost and the profit margin. For example- If you buy a product for $250, then it is the price of that product. And Value is the usefulness of any product to a customer. It can never be determined n terms of money and varies from customer to customer. For example- If you are going to a gym by spending 1000 bucks a month, the output seen is worth the expense, then it is the value that you create for a gym, regarding the service being offered there. Here the worth is its value.

This can be explained easily with an excellent example about water and diamond. Water is much essential for us to survive still it is of low price, while the diamond is just used for ornamentation and nobody dies without it, is priced very high. The reason behind this is its value, as the value of water is much for us, it is available at a low price, while the value of a diamond is less for us. Therefore, it is priced very high.

Stock market analysts make a lot of money sorting out the facts and figures along with the possibilities for success or failure. In the end, stock market analysts will arrive at a value, that is, what they believe the stock should trade for on the market. Often, the stock’s price is at or near that value, discounting daily fluctuations due to a rising or falling demand. However, there are many occasions where a stock’s price (what it is trading for on the open market) is way off the value. The amount a stock sells for (or indeed the price of anything) is merely the number that a willing seller and a ready buyer reach that is agreeable to each party. In other words, a stock (anything sold in a free market) is worth what someone is willing to pay. While the fundamentals influence stock prices over the long term, supply and demand rule stock prices in the short time. More buyers than sellers mean the price will rise, and more sellers than buyers say the price will fall.

Traders live on price changes, whether up or down. They make money by figuring out which way prices are going to move and taking a position to profit if they are correct. Investors are more concerned with value since over the long term an accurate assessment of value will guide their decision to buy or sell. Taking a long-term view doesn’t mean to buy and forget. Things change and often rapidly. Reassessing value or a regular basis is essential. If you do this, it is unlikely you will hold a failing stock or sell one with strong prospects.

Price is the amount you pay. Value is what the product or service pays you. This value could be measured in financial terms, emotional terms, physical conditions, or in any number of other ways. If you enjoy working out at a gym, the fulfillment you receive back from the $50 per month you spend on your membership makes the expense worth it. If some software you purchase costs $99 but saves you $250 per month and four hours of work per week, it’s value is demonstrated in more free time and more significant cash flow. In finance and investing, the price of an asset is just the market price of that asset. It is the price at which an investor/buyer is willing to purchase an asset in an arm’s length transaction given that full information about the asset is available to that said investor/buyer. Value of an asset is a fair assessment of the future cash flows an asset can be expected to generate after deducting all investments and expenses and then trying to put a price on those cash flows today.

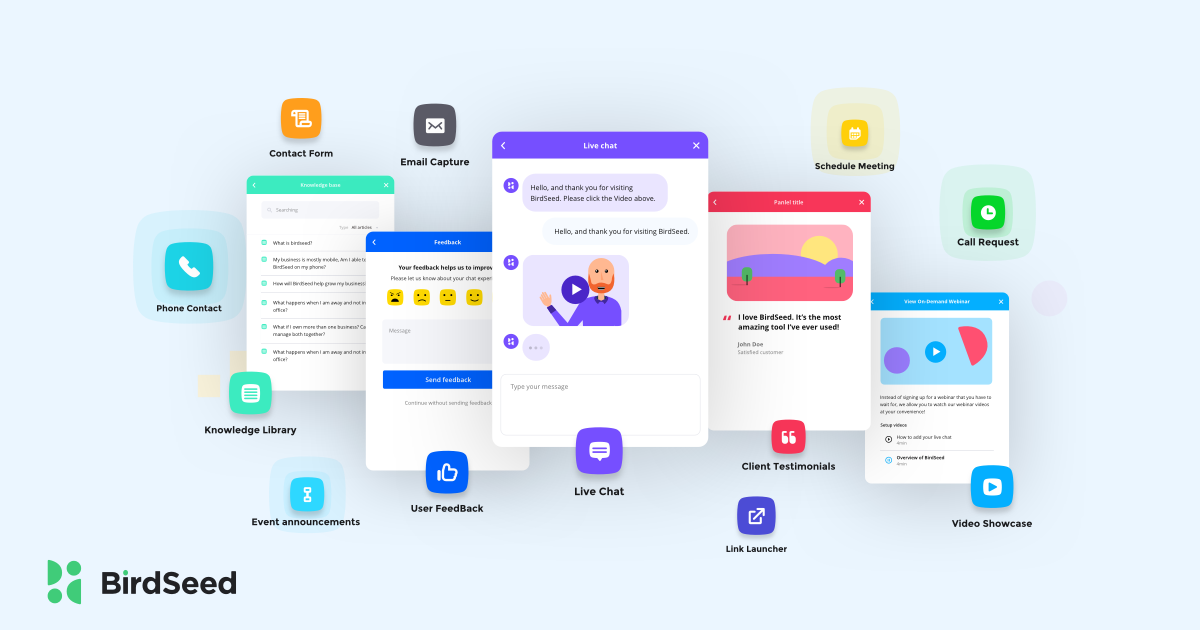

BirdSeed Allows Your Business To Add Great Value To A Customer

You may have heard the old adage, “It is not business, it is personal”. Well, the modern slant is that a business these days must be personal. Customers want to know and feel like they matter and are not just a number on a balance sheet. BirdSeed allows you to reach the customers where they are at and give them the ability to communicate and engage your company in the way they most prefer and even after business hours. Learn more about how BirdSeed can add value to your company at BirdSeed.io